Here are some of the often asked questions we get on the price of an organization insurance coverage policy: What happens if I don't have local business insurance coverage? Without insurance, do not anticipate to maintain your organization open for long. insurance. A significant event can happen any time that triggers substantial damages to your business.

How can I reduce my obligation insurance policy prices? There are a pair of ways you can reduce your responsibility insurance policy price.

If you have employees, you will have to bring Workers' Compensation Insurance Policy. businesses. Not having this insurance can be a drawback to you.

A general liability insurance coverage policy is a must-have to protect versus the possibly terrible expenses of a lawsuit over a physical injury or building damage. At any organization, a site visitor could journey as well as suffer an injury. If the visitor takes legal action against, lawful expenses can escalate to the point where they can sink your business. commercial.

For instance, services that run marketing projects or blog post on social networks might encounter a claim if they upload web content that does not come from them, or make an incorrect case about a competitor. When a person sues your organization even if it's a pointless suit you'll have to pay lawful defense expenses, such as the expense of working with an attorney.

Things about How Much Does $1 Million Liability Insurance Cost For A Small …

Elements that impact your business insurance coverage expenses Several aspects play a duty in computing your company insurance coverage expense. These variables can differ significantly from business to company.

Number of staff members Businesses with numerous workers can expect to pay even more for insurance because their possibility for insurance claims are greater than a business with less, or no, workers. Each additional employee increases direct exposure to crashes as well as various other problems that may lead to an insurance claim. If a company has workers, it needs to lug employees compensation protection.

A tiny organization plan with a $1 million/$2 million accumulation, will normally cost even more than a policy with a $1 million/$1 million accumulation. An accumulated limit is the most an insurance coverage firm will certainly pay toward an insurance claim during a policy term.

These insurance coverage levels commonly can be adapted to fulfill your certain demands, as well as they affect your last price. These three aspects stand for the essentials, as well as every local business owner must recognize with them – commercial insurance. Obviously, there are various other elements that can affect your organization insurance coverage expenses including: Home Equipment Area Time in company And even more There's a lot to think about when guaranteeing your organization, but obtaining aid is very easy.

It's that simple. More details.

Fascination About Commercial Umbrella Insurance Policy

insurance crime insurance commercial insurance liability business insurance company

insurance crime insurance commercial insurance liability business insurance company

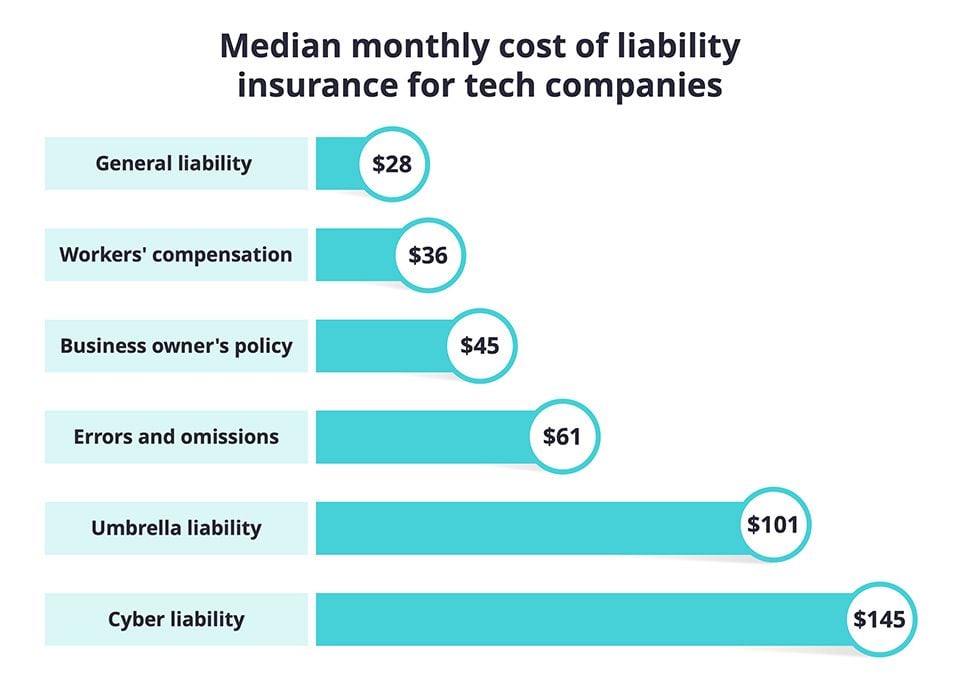

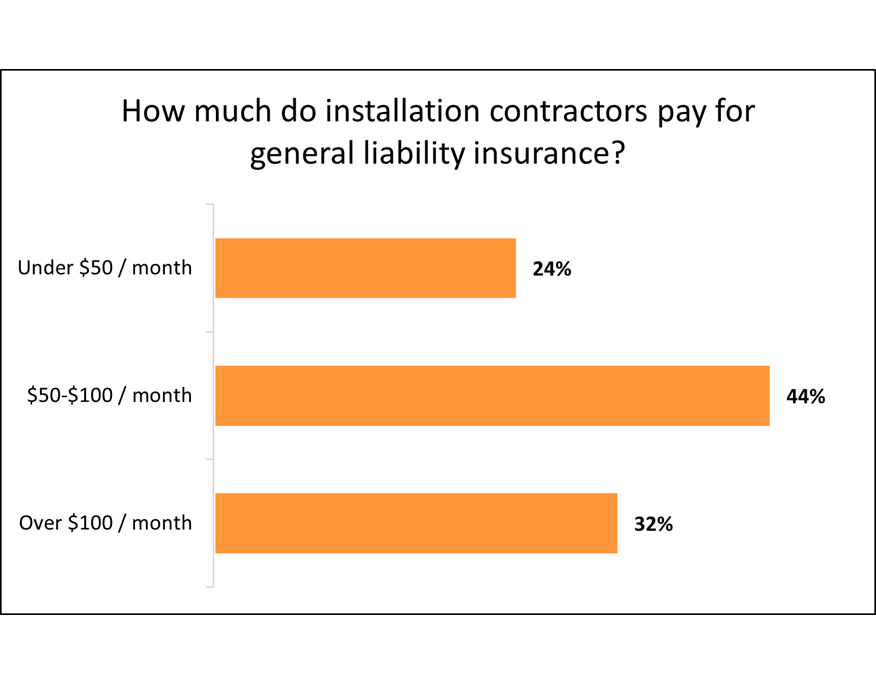

Just how much does basic liability insurance policy cost? Costs will differ as a result of business' dimension, location and industry – from as low as $27/mo for small companies to thousands each month for big ones – small business. You can skip to the following solution to the just how much does general liability insurance coverage price as well as business obligation insurance policy price inquiries – making use of these links: In recap, below is a listing of the primary aspects that identify how much works responsibility insurance cost and basic responsibility insurance policy expense? – If you possess a white collar organization, such as a publication keeping firm, your costs might be less than, state, a tree trimming business, where the prospective threats are greater.

Insureon says the average (mean) cost of their 18,000 policies has to do with $100 a month, while the median price has to do with $50 per month. This means that there are a whole lot of organizations that pay $50 or less as well as a little number that pay fairly a great deal greater than $100. errors and omissions insurance.

professional liability professional liability errors and omissions insurer professional liability insurance

professional liability professional liability errors and omissions insurer professional liability insurance

Coverage B – Responsibility protection for problems due to individual and advertising and marketing injury guarantees https://s3.eu-west-1.wasabisys.com/unbiased-view-homeowners-insurance/index.html your legal responsibilities that develop from a violation. It additionally consists of the costs associated with suits as well as other legal proceedings. small business insurance. The limits of insurance coverage must be enough to deal with severe injuries and the hurt person's loss of revenues.

Each of these protections is subject to specific plan exclusions, conditions, and also meanings. Area III – Limits of Insurance Policy: Explains how each restriction of insurance applies as well as how they work together and associate to one another.

Several of them entail the named insured's responsibilities after a loss. Insurance coverage is voided if several of these conditions are gone against. Section V – Meanings: Defines certain words and phrases made use of with and relevant to the protection given. They are various than the ones located in the thesaurus and are really essential since coverage can be given or taken away via a definition (small commercial insurance).

Facts About How Much Does Massachusetts Umbrella Insurance Cost? Uncovered

Some sectors are inherently extra high-risk than others. If you are company expert, there's not a whole lot of damages that your company can create, so your general liability insurance policy will likely cost-effective. On the other hand if you do acquiring work, your risks are normally greater to cover any type of prospective damages your company may create. errors and omissions.

If you have actually obtained 10 employees, a retail office, and $100,000 of month-to-month capital, your insurance coverage will have to shield every one of these points. This indicates employee's payment insurance policy, property insurance coverage, as well as defenses against theft. The state and postal code of your company contributes in the expense of your insurance coverage too.

If your service is a location that gets even more wind and rain and hailstorm damages, this can have a result on your premiums. Insurance business choose to guarantee organizations that have experience.

Even more experience generally means less opportunity of a case due to the fact that the longer you do the something, the much better you access it. A skilled tree leaner will commonly have a smaller possibility to drop a tree on a house than an unskilled firm. The items that your insurance policy covers will have a big effect on the final price – cyber insurance.

Workers Payment Insurance coverage: In nearly every state employers must supply workers comp when there are W2 staff members. Employees compensation spends for the healthcare of employees and can replace a section of lost salaries – despite that was at mistake for the injuries.

The The Answers To All Your Questions About Umbrella Insurance Statements

excess and surplus businesses errors and omissions insurance errors and omissions professional liability insurance

excess and surplus businesses errors and omissions insurance errors and omissions professional liability insurance

Key Takeaways Purchase life insurance coverage at the very least 10 to 15 times your revenue; if you make $100,000 every year, that's $1 million. Represent any added prices, like common financial debts, when computing your protection needs. There are no limitations on exactly how your recipients spend a $1 million life insurance policy survivor benefit.

Rate picture valid as of 10/08/2021. What does a million-dollar life insurance coverage policy cover? When the insurer pays the survivor benefit to your beneficiaries, there are no restrictions on exactly how it's invested. Here are some common means beneficiaries spend the fatality benefit:Child care or dependent care, College tuition, Investing, Medical expenditures, Monthly bills and also day-to-day expenses, Outstanding debts, The survivor benefit is normally paid out as a round figure, which suggests you get the entire survivor benefit after filing the fatality case, tax-free.

Each life insurance business comes close to insurance coverage maximums in different ways, so searching is the ideal means to guarantee you obtain the appropriate quantity of coverage. One million dollars can seem like a whole lot of life insurance policy, yet if you have dependents or financial debts it might be the minimum amount of coverage you require. excess and surplus.

insurance business liability insurance insurance carriers insurance small business cyber insurance

insurance business liability insurance insurance carriers insurance small business cyber insurance

It is not be utilized as a replacement for competent insurance policy, legal, or tax advice from a licensed specialist in your state – insurance small business. By utilizing this blog site you recognize that there is no broker client connection between you as well as the blog and also internet site author.

An excellent guideline is to have coverage that's regarding 5 to 10 times your yearly income. So if you earn $100,000 a year, a $1 million life insurance policy may be the appropriate option for you. professional liability insurance. Or if you earn much less however have significant financial debts like a home loan or trainee fundings, it might still be the right fit.

An Unbiased View of How Much Does A $1 Million Dollar … – Heyiamindians.com

A healthy 35-year-old female can purchase a 20-year, $1 million term life insurance policy plan from Place Life for about $29 per month. For those of you readers that wish to understand all the factors that go right into choosing if a $1 million life insurance policy is ideal for you, keep reading.

, it can be a little bit much more hard to determine the best amount of protection considering that they do not practically make an income.

And keep in mind: yes, households must have protection on stay-at-home mothers and papas. The cost of a $1 million life insurance coverage policy It may stun you exactly how affordable $1 million in coverage can be.

As well as remember, pricing for insurance coverage is cost effective the more youthful and also healthier you are. That's why, if you recognize you need insurance coverage, you'll desire to secure in your reduced price currently.

A life insurance coverage calculator will take into account your age, income, debts and family structure debts to supply a suggested term size in addition to protection amount that may be best for your scenario. A longer-term plan will certainly cost more, however it additionally allows you utilize your current age to secure a lower price for a longer time period.

The Buzz on How Much Does A Million Dollar Life Insurance Policy Cost?

Life insurance policy scores are essential to think about when purchasing a policy (excess and surplus). Life insurance policy firms get scores from independent agencies based upon their economic toughness, along with the rating agency's evaluation of the firm's claims-paying capability. To put it simply: It's an indication of the insurance firm's capacity to pay a claim if you were to die.

Life, which are ranked A++ by A.M (business's). Finest. You can merely compute your requirements, get a quote, use online and also, if authorized, start your protection the exact same day.

Respond to each concern honestly and honestly for the most accurate rates and also results. You don't have to predict the future One downside of obtaining life insurance policy is that it makes you contemplate your very own death, but that features an upside. By considering what would certainly take place to your enjoyed ones if you died, you additionally have to consider what you're worth, economically speaking, and the answer is typically a great deal more than you think.

In a couple of mins, it can assist you determine you and also your family's requirements, and offer you a customized quote for insurance coverage. After thinking about just how your family might afford these expenses without your revenue, you may discover that $1 million in coverage is simply right, or you might find that you need a bit extra or a bit much less.