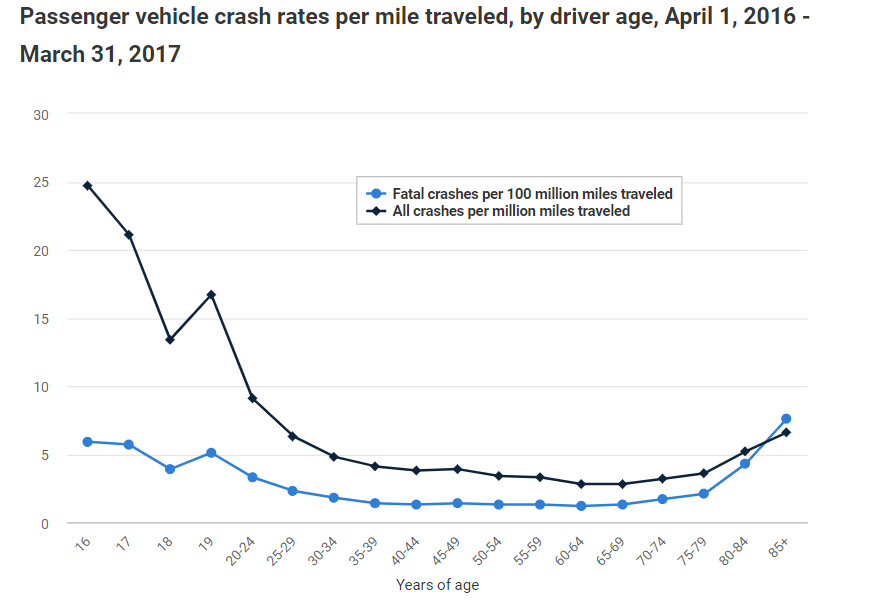

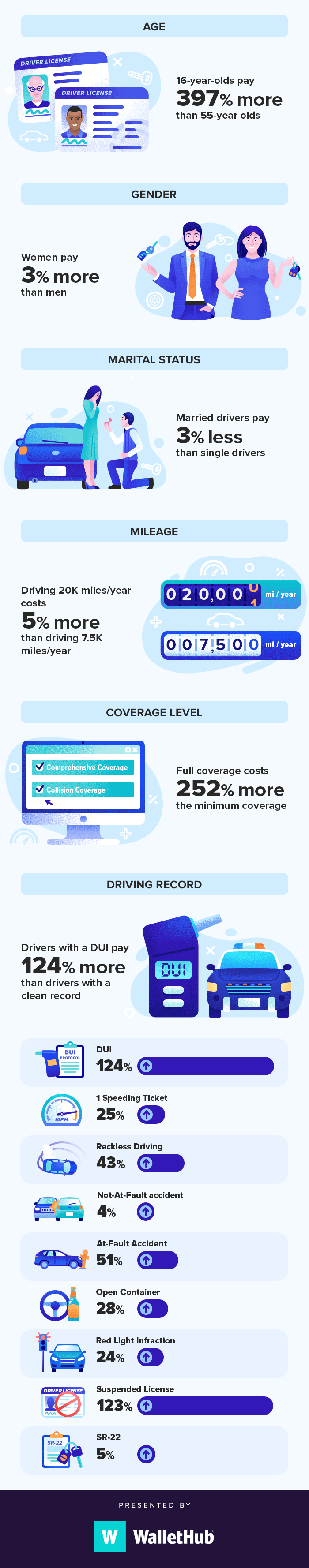

Some cars are more secure than others as well as carry out far better in crash tests. Do you intend to pay less for your car insurance coverage? Well, you may wish to consider a car that insurance providers think about safe as well as trustworthy. Auto insurance does take a look at your age as well as sex for risk as well as rates. Chauffeurs under the age of 25 will certainly pay higher prices due to inexperience since they have a higher risk of entering into an accident.

While guys under the age of 25 are priced quote higher rates, woman may pay a little a lot more when older. Some areas have greater prices of theft and crashes. Insurer must stay lucrative, which is why they factor this in. People who have not gotten married pay greater costs than couples, studies reveal.

A helpful piece of advice is to pack your residence and also car insurance. You can also take advantage of multi-policy discounts with other types of protection, including a boat or motorbike.

Facts About Car Insurance Discounts – Travelers Insurance Revealed

Lots of people recognize that drivers in their teenage years and early 20s pay some of the greatest costs for car insurance coverage. As we age, nevertheless, you may find that car insurance policy gradually decreases to a lot more inexpensive premiums. To help you recognize more concerning vehicle insurance premium expenses, checked out on.

The concept behind this is that you end up being a more seasoned vehicle driver, and also end up being much less most likely to make a claim. As long as you keep a clean driving document, after that your auto insurance coverage costs ought to slowly drop from age 20 to 25. The more experience you have, the less you can be anticipated to pay for automobile insurance policy.

If you acquired your certificate at 18, you only have 3 years of driving experience by the time you turn 21, therefore the decrease in costs may not be as considerable. Generally, Have a peek here it's unlikely that your car insurance rate will increase with age. Statistically, chauffeurs in their 40s, 50s, and 60s are some of the safest motorists when driving.

The Definitive Guide for Average Car Insurance Rates By Age And State – Wallethub

For more info, please see our as well as Having a car is pricey. And while you can't do much concerning prices like depreciation as well as taxes, there are means to assist you manage the cost of your insurance policy settlement.

What Is No Down Payment Cars And Truck Insurance? No-down-payment vehicle insurance policy enables you to get a full automobile insurance coverage policy, but pay for it in installations instead of a lump-sum costs.

supplies car insurance policy in 26 states with a typical yearly costs of $1,351. It flaunts the third-highest rating in cases fulfillment in J.D. Power's 2020 study, and provides a long list of discount rates that can help you even more drive down the prices of cars and truck insurance coverage. Steps to Getting Cheaper Protection Via a Layaway Plan, There are plenty of methods to conserve a lot more on no-down-payment automobile insurance policy.

10 Easy Facts About Car Insurance Quote In Singapore – Budget Direct Insurance Shown

When you're car purchasing, take into consideration just how your selection will influence your prices. Look for the very best offer, Among the most effective means to locate economical auto insurance coverage is by "looking around for insurance coverage before you get your revival," states Mark Friedlander, supervisor of corporate interactions at the Insurance Info Institute.

Paying for the whole premium upfront rather than each month is typically one means to gain a price cut, though that will feature a high rate tag and "not everyone can pay for that within their budget plan," Pedestrian claims. However if you can pay in advance, "it does save you from having to consider the month-to-month repayment, and also you obtain the discount rate, too."When you're buying cars and truck insurance policy, don't be shy.

Boost your credit rating, Depending on where you live, your credit score can play a function in how much you pay for auto insurance coverage costs. Some states, like The golden state and Hawaii, don't permit insurance firms to take credit score ratings into consideration when establishing rates.

How Much Is Car Insurance For 25-year-olds? – The Zebra Can Be Fun For Anyone

The insurer will either take the regular monthly repayment out of your monitoring account or bill your credit history card instantly each month on the due day. Some insurance policy firms give yet another price cut when you continually pay on time.